In an earlier blog post we discussed the importance of client service to institutions from account opening and trading to operational support and beyond. In today’s digitized world, technology connection is paramount to the success of any U.S. broker-dealer offering online trading and brokerage services.

However, even with unparalleled technology, customer service is still crucial to the success of any business. Unfortunately, support is increasingly relegated to automated, canned answers that offer no real assistance. Not only that, but all too often, clients reach out to a service provider for help with an issue that easily could have been prevented with a proactive, customized approach to service.

Here at ViewTrade, our Client Services Team takes the Know Your Customer rule (KYC) well beyond simply collecting documents at account opening. Connecting with our B2B clients when they need us, knowing how each broker operates, and having a fundamental understanding of how this business works is essential to building genuine relationships and creating a positive experience for the foreign financial intermediaries we work with.

A genuinely proactive approach to stellar service requires a team that can:

- See a potential complication before it happens or anticipate a client need

- Understand the impact and communicate with clients

- Effectively resolve the situation based on knowledge and experience

- Implement a strategy to remedy and prevent any further occurrences

A customized approach requires a team of associates that recognizes when an individualized strategy is needed for a particular firm’s specific and unique circumstances.

That is what sets ViewTrade apart. While we offer a comprehensive, user friendly equity trading platform with algorithmic trading that is also available via mobile application for both retail and omnibus accounts, we will always maintain that financial services remains a people business where relationships can mean the difference between success and failure.

We work with broker-dealers, banks and fintech firms around the world. Our clients often ask us how they can deliver greater value to their own clients (the way they experience it from us).

This begins with getting to know the individuals you interact with each day.

How do they like to work?

Are they chatty?

Or are they “all business” with no appetite or patience for light casual conversation?

How experienced and knowledgeable are their staff on how operations work?

Some clients have years of experience, are quite autonomous and need very little instruction when making certain complicated requests. On the other hand, some clients prefer to let us take the lead and guide them step by step. Once you truly know your client, you have a feel for exactly what they are looking for and the specific information they need.

We take pride in having a connection to the firms we work with on an individual level. We recently completed large internal account transfers for 3 different clients. These can be complicated due to several reasons that our clients do not always take into consideration. We sent instructions that were customized to each individual firm based on their level of knowledge and understanding of how these kinds of transfers work. All three transfers were successfully completed on time with no issues despite different instructions for each. Why? Customization for individual needs not only streamlined the process but made our clients incredibly happy.

Having a healthy relationship with your service provider has many advantages.

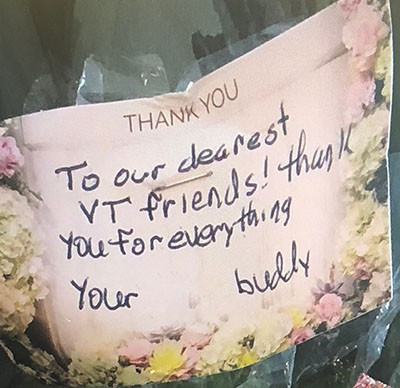

ViewTrade takes tremendous pride in building relationships and creating reliable connections to better serve our clients, so they can better serve their clients.

Connect with us to learn more about how we can work with your firm too.