Annabel Lukens has worked with ViewTrade since its early days in 1999. For over 10 years she has been building relationships with broker-dealers outside the U.S. helping them tap the technology they need to access U.S. markets. Prior to joining ViewTrade she worked as a stockbroker for two decades.

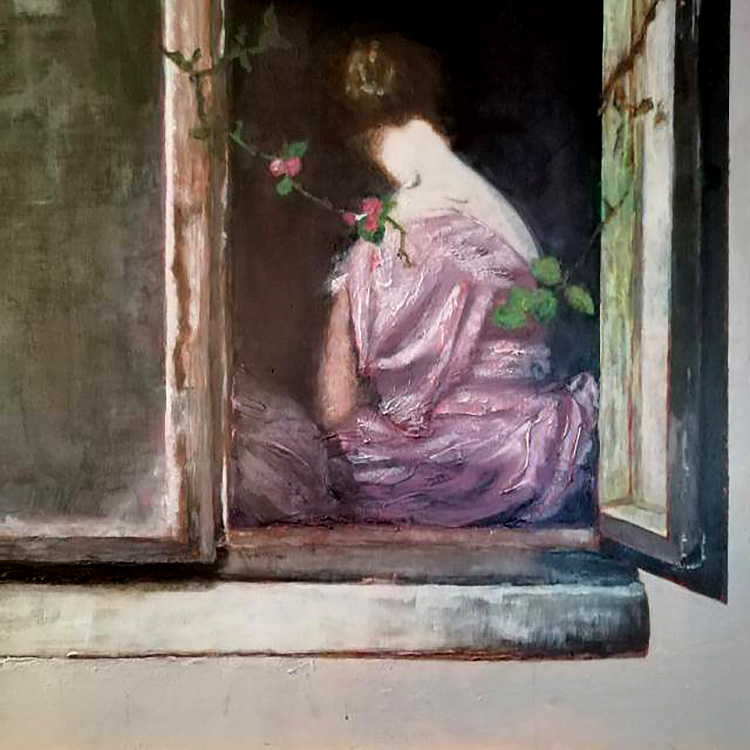

When Annabel is not working to help B2B firms in Europe, India, and Latin America, she enjoys spending her free time painting with acrylics. Working with B2B clients is also a fine art—as each client has different needs based on their own customer base and business model. Just as she works to achieve the right color combinations in her paintings, she does much the same to find the right solution to fit the needs of ViewTrade’s clients.

Given her extensive career in finance, we decided to ask Annabel a few questions about the industry changes she’s seen, how ViewTrade has grown to work with clients all over the world, and what she is most excited about in the years ahead.

Q: How has the landscape changed for broker-dealers and fintech firms?

Technology has played an increasingly important role in every industry, and financial services is no exception. As a B2B firm, we work with broker-dealers, B2C fintech firms and many other financial services firms to help them satisfy the needs of their own customers who are individual investors.

Many of today’s investors want simpler, sleeker user interfaces (UIs) that are exceedingly easy to view on mobile devices and provide support for active traders. Those demands can be resource intensive for a B2C firm to build from scratch, so they come to us because we can help them accelerate speed to market efficiently.

Q: How do you and the rest of the ViewTrade team manage working with firms around the world?

We cater to diverse markets working with traditional broker-dealers and more progressive

fintech firms and digital banks. While we work with some of the biggest and best in financial services, we take pride in offering boutique, personalized client service covering every time zone. We frequently connect with clients for phone calls and video calls and work hard to ensure we are available day and night no matter what time an inquiry comes in to ViewTrade. I am in Spain and I cover the timeline between Taiwan and the United States. Providing high-quality and stellar customer support is a top priority for ViewTrade.

Q: How are global firms differentiating themselves as competition among brokerage firms increases, and more and more individuals want to become investors?

The race to keep ahead and take the lead is fierce. The focus should always be in favor of the end customer and maintaining their business, expanding on the existing while growing the client base. How a company chooses to do that is key, and it starts with arming their investors with the tools to make well-informed decisions with their money. A well-informed customer is going to be more confident in making decisions, and potentially trade more. Subsequently, they will have better results overall and are more likely to stay with your brokerage firm and may even invest more. Today, firms are expanding their products and services by offering trading in U.S. equities, fractional shares trading, corporate services, etc. as well as banking, cryptocurrencies, money transfer, and more. In many cases they are being combined to offer customers more from one account.

I am still in favor of differentiating your firm through customer service. I know it’s disappearing at the investor level, especially with mobile trading, but I’m not sure that is a good decision for many.

Now when it comes to having the support you need at the broker-dealer or similar level, it is crucial that you know someone is always going to be there to help your business. And I think it matters that you are accustomed to speaking to the same people, and over time developing a deep working relationship. It makes a difference.

Q: How does technology play a role in clients’ decision to work with ViewTrade?

Broker-dealers and fintech firms are often burdened by the complexity and intensity of setting up their internal infrastructures and vendor connections, while also juggling the need to meet and exceed investors’ expectations. The technology that our sister company Orbis has built is “Plug and GO”.

We have all different types of clients–some of our clients have developed their own front end, and require a FIX connection to send us orders, others want a trading platform ready-made with a custom onboarding process. The trend seems to be headed toward building your own platform via APIs or updating what you currently have by adding APIs. Orbis meets clients’ needs, not the other way around.

Q. What are some of the challenges facing foreign broker-dealers, fintech firms and digital banks, etc.?

We are seeing providers competing with broker-dealers and fintech firms for the same retail clients. It is important to understand and ask, “Is the provider that I am receiving services from also competing with my firm? ”

Wherever ViewTrade’s clients are and whatever their level of experience, the U.S. markets are usually second to the firm’s local or regional markets. Even if they are solely offering U.S. equity

trading, many times their knowledge of the process may be limited. We are here to not only inform them, but also take away a lot of the added work that they simply don’t have the time to deal with because they are focused on their local market or other projects. That is what 21 years of working with non-U.S. firms has enabled us to do for them.

Q. What do you think distinguishes ViewTrade?

Without a doubt our technology capabilities, our commitment to stellar service and the depth of our expertise helping firms grow their U.S. businesses.

- We do not compete for our client’s retail business; this is so important to remember.

- ViewTrade Securities and Orbis Systems make up ViewTrade Holding Corp, it’s the perfect marriage!

- We provide a one-stop-shop for foreign financial institutions, fintechs, and digital banks that can pick and choose what pieces of the puzzle they need. We provide the A-Z for U.S. markets!

Since we started offering online trading our focus has been on non-U.S. entities. Most companies in our space started with U.S. clients and much later ventured globally.

ViewTrade has always been passionate about helping firms outside the U.S. and thus we’ve built expertise and we’ve created new offerings to satisfy their needs, helping them meet their own customers’ needs. We listen to our clients, and the evolution of new products and services is often based on what they tell us that they want.

Q. What are you excited about in the months ahead?

First, I’d like to mention the whirlwind of the past 12 months—with the global chaos caused by COVID, firms’ teams working from home, and record trading volumes, many firms have delayed projects while at the same time requests have increased for additional products and services.

Tackling day-to-day challenges has been difficult for everyone. Having support from ViewTrade covers a good part of the burden for our clients and helps them to focus on all the other business tasks that need to get done.

The direction of the industry is extremely exciting. In the U.S. 55% of the population invested in the stock market in 2020.* This is increasing exponentially around the globe, as the markets have become accessible to everyone. Fractional shares and mobile trading have given rise to the micro-investor. Young investors (millennials and gen Z) are more informed and marking the pace for what is hot and what is not. And this is incredibly positive for broker-dealers globally. At the same time, because of all of this, it becomes ever more important for brokers to retain their end customers by offering them the support needed, online all the way, with the best execution, tools, and content, and to stay ahead by constantly adding products and services so those customers can make more informed investment decisions.

In the past two years the investment industry has transformed, and I believe the next five years will be incredible. I am looking forward to painting the picture of a bright future for ViewTrade.*