After graduating from Rutgers University with a bachelor’s degree in criminal justice in 2015, Garrett decided to join ViewTrade Securities to work with his father, Bob Dombrowski, a major influence in his life who sparked Garrett’s early interest in securities trading. Garrett currently works as the Operations Manager supporting non-U.S. financial institutions trading in U.S. markets.

For years, securities traders looked at fundamental and technical analysis to justify their investment decisions and to examine the future price movement of a security. Day traders, hedge fund managers, investment advisers and retail investors have all used one of these approaches in helping with their allocations.

It is hard not to notice the changes over the past decade within the U.S. stock market. The introduction of more millennials into work life, the technological evolution of trading on-the-go, and investment “advice” from non-professional internet influencers have contributed to the transformation.

Trading volumes have been hitting record highs since 2020.

Much of that increase is being propelled by retail trading as the pandemic forced people to work from home, giving them more time to focus on their finances and learn about financial markets. More than 10 million new retail brokerage accounts were opened last year.1 And a study shared by FINRA2 indicated that over half of the investors between the ages of 18 and 29 who participated in the survey opened a new investment account at the suggestion of a friend.

New investors are increasingly buying cryptocurrencies and trading meme stocks based on a confluence of events, compromising the idea of fundamental and technical analysis as a starting point.

Technology has enabled amazing advances in HOW retail investors can trade. Are retail investors carefully considering WHAT to trade? And WHY?

Overall, the retail investor mindset has shifted. Instead of putting money into the hands of an experienced financial professional, new retail traders are making decisions after listening to advice from friends and family who may be uninformed or inexperienced. The new generation of retail investors is reading online forums for trading “advice” and following social media influencers like Elon Musk. One single tweet can change the direction of a stock on any given day. Some are pouring their money into meme stocks, penny stocks and options, chasing momentum to get rich quick. Billions of dollars are moving between cryptocurrencies and equities.

At the same time, e-brokers and online advisory platforms have become the new normal. Years ago, the only way to look up a quote was to read the Wall Street Journal or have access to a Quotron terminal through an employer. Today, new retail investors can typically access quotes from their watches or phones, and can open and fund an account, and begin trading within the same day on their mobile device of choice via a free app from their online broker. They can even get approved for options trading with the swipe of a finger (that used to be a multi-week process!).

These technology trends have had a major effect on broker-dealers and fintech firms around the world, not just in the United States. Financial institutions are looking to U.S. markets to expand services to their customers to enable more investors to have easy access to U.S. markets.

And more and more investors are now able to buy a fraction of a share of a company while sitting on the other side of the world. While meme stock trading may be far from over, it may not be the most efficient way to take advantage of market opportunities.

Providing information to enable investors to make informed trading decisions is a key differentiator for many brokerage firms.

Viewtrade offers financial services firms several tools to plug in to their existing trading platforms enabling those firms to provide greater insight to their retail investors who wish to invest in U.S. markets.

And if your firm is in the early stages of thinking about tech solutions for trading in the U.S. markets, get in touch with us because we can help with that too.

ViewTrade has 20+ content offerings to help your retail investors examine securities in a variety of ways.

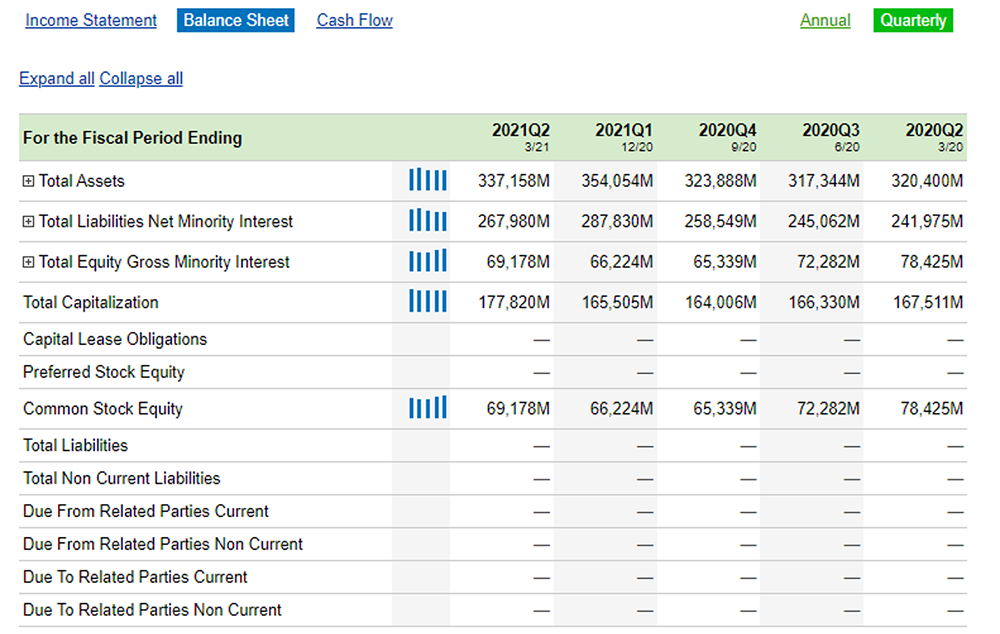

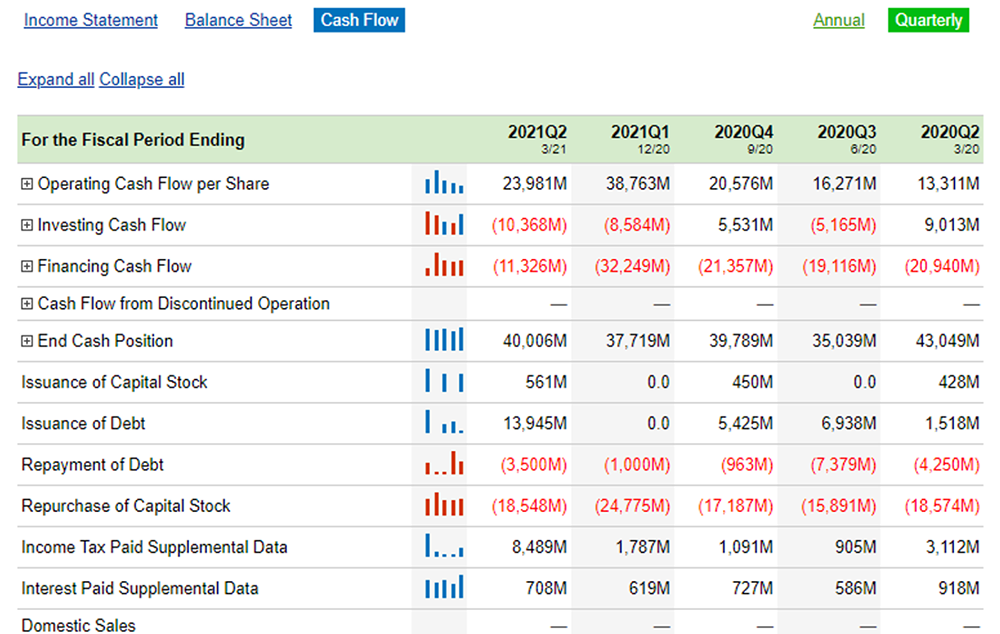

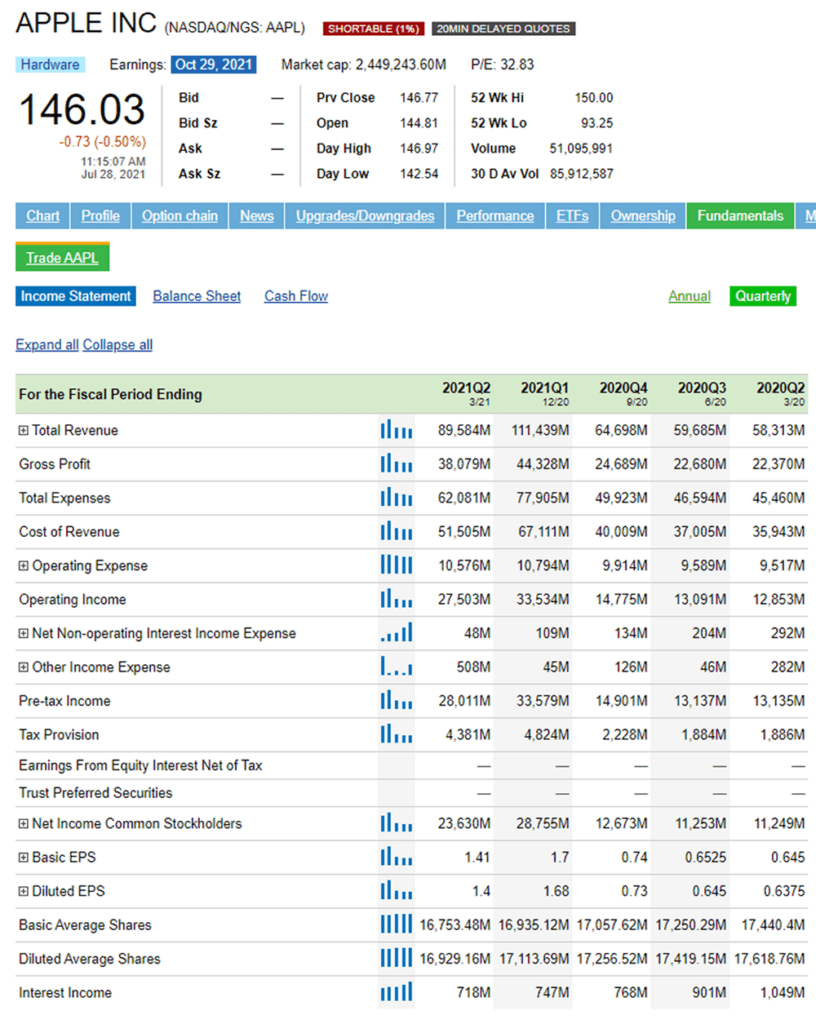

Common stock fundamentals that traders often consider include income statement, balance sheet, cash and revenue flow, etc.

Technical analysis offerings include chart analysis, price, volume, enhanced quotes, P/E ratio, 52-week H/L; 30-day avg volume; market cap; earnings calendar; real-time quotes; access to CAD quotes; U.S. option quotes; index quotes; National Best Bid and Offer (NBBO), analyst rankings; IPO center; heat maps; corporate action monitor; historical data; and SEC filings

Here is an example of the fundamental research function for (APPL) shown on our trading platform as of July 28, 2021:

If your company is interested in enhancing your brokerage platform to offer value-added solutions such as market data, news and research to help your investors make more informed trading decisions, contact us for a demo.

1. https://www.wsj.com/articles/new-army-of-individual-investors-flexes-its-muscle-11609329600

2. Consumer Insights: Money and Investing – February 2021 | Investing 2020: New Accounts and the People Who Opened Them by The FINRA Investor Education Foundation and NORC at the University of Chicago

Additional references:

– https://deloitte.wsj.com/riskandcompliance/2021/06/16/the-rise-of-newly-empowered-individual-investors/

– https://www.finrafoundation.org/sites/finrafoundation/files/investing-2020-new-accounts-and-the– people-who-opened-them_1_0.pdf

– https://www.cnbc.com/2020/05/12/young-investors-pile-into-stocks-seeing-generational-buying-moment-instead-of-risk.html